21st Century Accounting Tutorials - Payroll

Configure Tax Calculations

When you set up Payroll from scratch, use the Tax Calculations window only if user-defined Taxes apply to your employees or if you want to edit the SUTA Maximum taxable earnings.

Set up Tax Calculations factors fifth, after Income, Taxes, Noncash Benefits, and Accruals.

Of course, you can modify and add Tax Calculations factors at any time.

Run Payroll/Configure/Tax Calculations.

Press F9 to make a new entry.

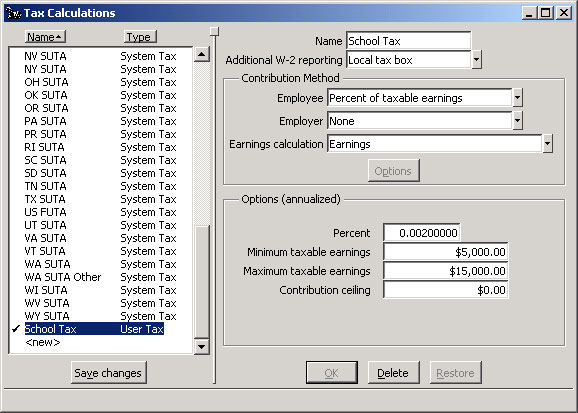

Name. Type School Tax for the name of the user-defined tax.

Additional W-2 reporting. Select Local tax box.

The default of "None" at "Additional W-2 reporting" is correct for Taxes supported by the Payroll Tax Updates. User-defined Taxes may have other requirements for W-2 reporting such as Local tax box or Other information box. Review your W-2 instructions if you are in doubt.

Contribution method

Employee. Select Percent of taxable earnings.

Employer. Press Tab.

Earnings calculation. Select Earnings.

The contribution method determines how the system calculates the tax. The employer does not contribute to the school tax. At "Earnings Calculation," you set up the earnings base -- straight earnings, earnings minus exemptions, and so forth.

Click the Options button to display the prompts associated with the contribution and Taxable earnings calculation methods in the Options part of the window below.

Percent. Type .002.

Minimum taxable earnings. Type 5000.

Maximum taxable earnings. Type 15000.

Contribution ceiling. Press Tab.

You enter the annualized limits, if any, for the local tax in the Options fields. User-defined Taxes may require maximum and minimum earnings levels to kick in. They may require contribution ceilings. You will need to enter such additional information the system uses to calculate the Tax.

You assign posting accounts when you assign a Tax to a company in Configure/Taxes. In this window, you enter the calculation information.

Click OK to save your work so far.

Here is how a completed Tax Calculations window might look.

Payroll: Configure Tax Calculations window

Click Save changes to save the factor.

Back To Top | Back To Main Tutorials Page