Colorado Paid Family Leave

Effective January 1, 2023

Starting January 1, 2023, most Colorado workers (full-time, part-time and seasonal) will see a new deduction on their paychecks of 0.45% of their wages.

For more information, visit the Colorado FAMLI website at https://famli.colorado.gov/employers/famli-toolkit-for-employers

To create a pay factor for this payroll tax, please follow these instructions:

- Backup your company data before making these changes.

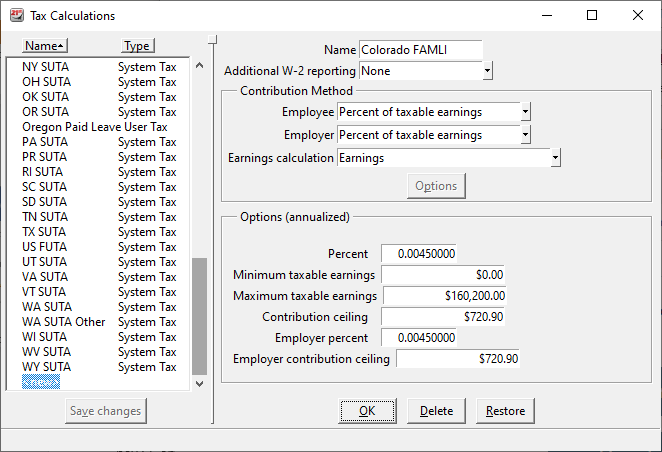

- Go to Payroll/Configure/Tax Calculations and create a new Tax similar to the one shown below. You can name it whatever you like.

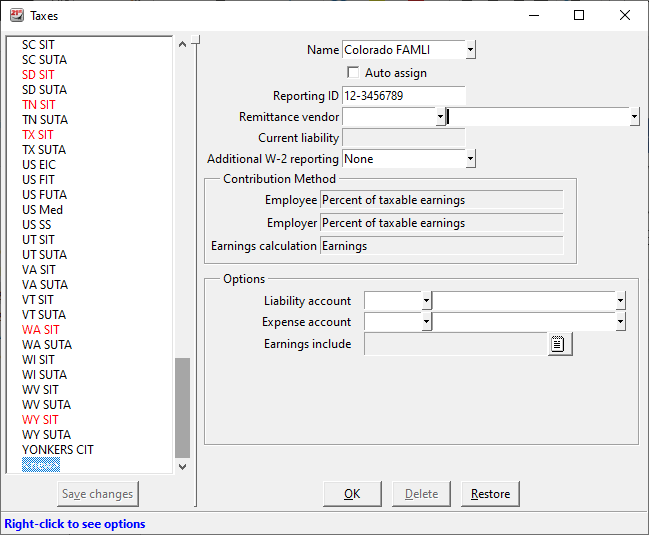

- Go to Payroll/Configure/Taxes and assign the tax to a Remittance Vendor, select relevant earnings, and assign Liability and Expense accounts similar to the following.

- Click OK and Save changes.

- Assign the Tax to your relevant employees.

- After posting your payroll, review the amounts in the Payroll/Print Taxes Activity report.