Information for COVID-19 Changes

Report FFCRA Covid related pay on W-2

WASHINGTON — The Treasury Department and the Internal Revenue Service today issued Notice 2021-53, which provides guidance to employers about reporting on Form W-2 the amount of qualified sick and family leave wages paid to employees for leave taken in 2021. The notice provides guidance under recent legislation, including: the Families First Coronavirus Response Act (FFCRA), as amended by the COVID-Related Tax Relief Act of 2020, and the American Rescue Plan Act of 2021.

Employers will be required to report these amounts to employees either on Form W-2, Box 14, or in a separate statement provided with the Form W-2. The guidance provides employers with model language to use as part of the Instructions for Employee for the Form W-2 or on the separate statement provided with the Form W-2.

The wage amount that the notice requires employers to report on Form W-2 will provide employees who are also self-employed with the information necessary to determine the amount of any sick and family leave equivalent credits they may claim in their self-employed capacities.

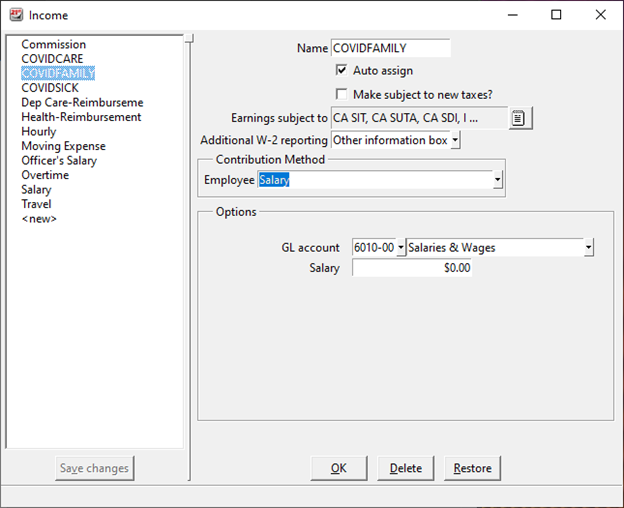

To report Covid related pay on Box 14 of the W-2, follow these instructions.

- Open Payroll/Configure/Income.

- Select the Income you wish to make changes to.

- In the Additional W-2 reporting box, click the pull-down arrow and select Other information box.

- Click OK and Save changes.