If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the November 30, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s ONLY.

Federal

2020 Federal W-2 and W-3 Forms - Preprinted, Plain Paper, and Electronic Filing

State Forms

None

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the October 31, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s ONLY.

Federal

941 Report - If you have created an Income Factor for COVIDFAMILY but have not calculated payroll for this Income, an error will occur when you attempt to Print the Quarterly 941 data and the Year Total 941 data. In order to resolve this problem, delete the Income factor called COVIDFAMILY.

State Forms

None

State and Local Income Tax

New Jersey (NJ SIT) High income bracket catchup rate for remainder of 2020

SUTA Wage Base (Maximum taxable earnings)

None

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the September 30, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s ONLY.

Federal

The IRS has updated Lines 13b, 24, and 25 on the 941 for the third and fourth quarters of 2020. Lines 13b and Line 24 are related to deferred Social Security taxes. Line 13b now includes employee deferred taxes as well as the CARES related employer deferred Social Security taxes. The total amount of the employee share of deferred taxes should be entered separately on Line 24.

Please visit IRS site at https://www.irs.gov/pub/irs-pdf/i941.pdf for more information related to this deferment.

Please note that there are no changes to the 941 Schedule B. The amounts on the 941 may not match the Schedule B amounts if you entered a deferred amount. If there is a discrepancy because of this deferment, enter the correct amounts manually. Please see the IRS page about Schedule B at https://www.irs.gov/instructions/i941sb.

The Year Total and 941 Quarterly Reports (accessed from 941 GUI) now include COVID-19 related Sick and Family Leave.

State Forms

None

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the July 15, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s ONLY.

Federal

Line 15 on Form 941 was not displaying correctly in certain instances. This has been fixed. If you are not affected by this issue, you do not need to install this update.

Please note that the Year Total Report available through the 941 module is not yet reconfigured for COVID-19 related Income. A separate Tax Update will be released when these changes are available. We appreciate your patience as we work through these changes.

The IRS has released some guidance regarding the W-2, Wage and Tax Statement for 2020. COVID-19 Qualifying Sick Leave wages and Family Leave wages should be reported on Box 14 as Other as well as in Boxes 1, 3, and 5. . If you have these types of wages, you can assign the Income Factors called COVIDSICK, COVIDCARE, and COVIDFAMILY to Box 14 in the following way:

This procedure can be done at any time.

State Forms

None

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the June 30, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s ONLY.

Federal

Support for 2020 Form 941 (Revised April 2020)

State Forms

None

State and Local Income Tax

Idaho (ID SIT)

SUTA Wage Base (Maximum taxable earnings)

None

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the May 10, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s ONLY.

Federal

COVID-19 Families First Coronavirus Response Act (FFCRA) US Social Security Employer exemption

This Tax Update contains changes related to FFCRA Sick Pay. If you have employees entitled to this type of pay, you will need to create the following new Income factors for wages required to be paid under the Emergency Paid Sick Leave Act (ESPLA) as enacted under the FFCRA. This Act requires employers with less than 500 employees to provide paid sick leave to employees unable to work or telework after March 31, 2020, and before January 1, 2021 due to reasons outlined below.

Create one or both of the following Income Factors to implement these changes:

In these circumstances, you are entitled to a maximum of $511 per day, or $5,110 total over the entire paid sick leave period.

In these circumstances, you are entitled to compensation at 2/3 of the greater of the amounts above at a maximum of $200 per day, or $2,000 over the entire two week period.

This Income must be subject to US SS and any other taxes related to this sick pay. Once you create this Income factor, apply it to eligible employees.

If you previously created an Income for this type of sick pay under a different name, you should change the Income name to COVIDSICK and/or COVIDCARE. In order for this change to be applied to eligible sick pay, it must be called COVIDSICK or COVIDCARE in all caps.

Qualified family leave wages you paid to your employees under the Emergency Family and Medical Leave Act under the FFCRA. This requires employers with less than 500 employees to provide public health emergency leave under the Family and Medical Leave Act of 1993 to an employee who has been employed for at least 30 calendar days. The requirement to provide leave generally applies when an employee is unable to wok or telework due to the need to care for a child under the age of 18 because the school or place of care has been closed, or the childcare provider is unavailable, due to a public health emergency. The first 10 days for which an employee takes leave may be unpaid. During this period, employees may use other forms of paid leave, such as qualified sick leave, accrued sick leave, annual leave, or other paid time off. After an employee takes leave for 10 days, the employer must provide the employee paid leave for up to 10 weeks. The qualified family leave wages can't exceed $200 per day or $10,000 in the aggregate per employee for the year.

Once you create one or both of these Income factors, apply them to eligible employees. This Income must be subjct to US SS and any other taxes related to this sick pay.

If you previously created an Income for these types of sick pay or family leave under a different name, you should change the Income name to COVIDSICK, COVIDCARE, or COVIDFAMILY. In order for this change to be applied to eligible sick pay, it must be called COVIDSICK, COVIDCARE, or COVIDFAMILY in all caps.

Please click here for more detailed instructions on applying these changes.

State Forms

None

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

NOTE: You will not be able to run After the fact payroll or do Employee Adjustments for 2019 once you install this or any Payroll Tax Update that contains Tax Tables for 2020 W-4s. If you still need to enter payroll information for 2019, please install the March 31, 2020 update. If you already reconfigured your employees for 2020 W-4s, you will need to reconfigure them for 2019 before making adjustments. Please contact us if you require assistance.

Questions?

If you have questions about this information or require our assistance, please contact us here.

Please do the following before installing this update:

Configuration information for this Payroll Tax Update

Due to changes to Federal Income Taxes for 2020, you will need to reconfigure your employees before calculating your next payroll, even if you are not using 2020 W-4s. Please keep this in mind before installing this Tax Update as you will need to reconfigure your employees in order for these Tax Tables to be implemented.

After installing this Tax Update, if you do not see the new fields available in Configure/ Employees, go to Payroll/Calculate Payroll, and start a 2020 payroll. Close out of Calculate Payroll and you should see the fields in Configure/Employees.

If you have multiple employees you can reconfigure a little at a time by saving your changes as you go. However, you will not be able to Calculate Payroll for employees that have not bee reconfigured. You can also OK all of your employees and then go back and reconfigure them when you are able. Please note that when you OK your employees, the filing status will default but the status may not be correct. Please double check the status before you run payroll for those employees.

Below you will see references to 2019 Form W-4. This applies to Form W-4 from previous years as well. If an item below only references 2020 Form W-4, you can leave that box blank if you are using a previous year's form.

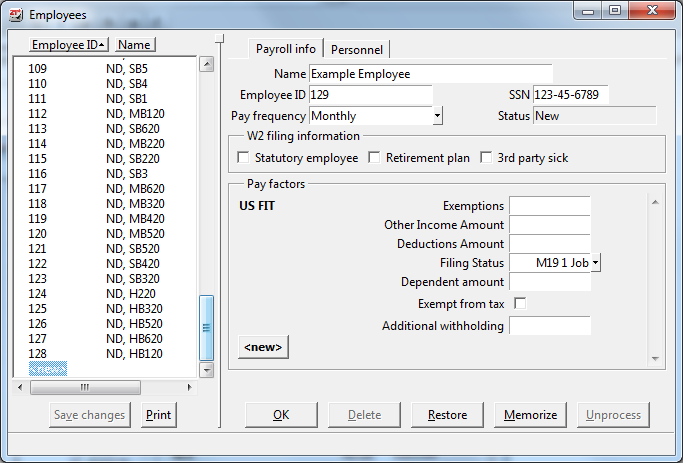

In Payroll/Configure/Employees, you will see the following Pay Factors for US FIT :

Exemptions – If you are using 2019 Form W-4, leave the number of exemptions as they are. If you are using 2020 Form W-4, use the chart below to enter the correct number:

Filing Status |

Step 2 |

Number to enter |

Married Filing Jointly |

Step 2 NOT checked |

3 |

Single, Head of Household, Married Filing Separately |

Step 2 NOT checked |

2 |

All Filing Statuses |

Step 2 Checked |

0 |

Other Income Amount – Enter the amount in Step 4(a) of your 2020 W-4 Form.

Deductions Amount - Enter the amount in Step 4(b) of your 2020 W-4 Form.

Filing Status - Use the tables below to enter the correct status.

2019 Form W-4:

Filing Status |

Status Code |

Married Filing Jointly |

M19 1 Job |

Single, Married Filing Separately, or Head of Household |

S19 1 Job |

Nonresident Alien |

NRA |

2020 Form W-4 Step 2 NOT checked:

Filing Status |

Status Code |

Married Filing Jointly |

M19 1 Job |

Single or Married Filing Separately |

S19 1 Job |

Head of Household |

H20 1 Job |

2020 Form W-4 Step 2 Checked:

Filing Status |

Status Code |

Married Filing Jointly |

MFJ20 2 Job |

Single or Married Filing Separately |

S20 2 Job |

Head of Household |

H20 2 Job |

Nonresident Alien |

NRA2020 |

Dependent Amount – Enter the currency amount listed on 2020 Form W-4 in Step 3.

Exempt from Tax – Check this box if the employee is exempt from tax.

Additional Withholding – Enter the currency amount listed on the 2020 Form W-4 in Step 4(c). This is the additional amount to be withheld per pay period.

North Dakota SIT

Please be aware of the following changes to North Dakota statuses and allowances. You will need to reconfigure your employees in Payroll/Configure/Employees before you will be able to Calculate Payroll.

Form |

Factor |

Change |

2019 Form W-4 |

Head of Household |

Select Filing Status 19 Head of Household |

2020 Form W-4 |

Head of Household |

Select Filing Status 20 Head of Household |

2020 Form W-4 |

Allowances |

Enter Zero Allowances |

If you are not ready to reconfigure your employees for 2020 W-4s, please click here to install the March 31, 2020 Payroll Tax Update which includes everything below with FIT for 2019 or previous W-4s.

Federal

None

State Forms

None

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

State |

2020 |

2019 |

AK SUTA |

41,500 |

39,900 |

CO SUTA |

13,600 |

13,100 |

HI SUTA |

48,100 |

46,800 |

ID SUTA |

41,600 |

40,000 |

IL SUTA |

12,740 |

12,960 |

NC SUTA |

25,200 |

24,300 |

ND SUTA |

37,900 |

36,400 |

RI SUTA |

24,000 |

23,600 |

NOTE: You will not be able to run After the fact payroll or do Employee Adjustments for 2019 once you install this or any Payroll Tax Update that contains Tax Tables for 2020 W-4s. If you still need to enter payroll information for 2019, please install the March 31, 2020 update. If you already reconfigured your employees for 2020 W-4s, you will need to reconfigure them for 2019 before making adjustments. Please contact us if you require assistance.

If you are not ready to reconfigure your employees for 2020 W-4s, please click here to install the January 31, 2020 Payroll Tax Update which includes the state changes below and FIT for 2019 or previous W-4s.

Federal

Support for 2020 Form 941

Support for 2020 Form 941 Schedule B

State Forms

None

State and Local Income Tax

Arkansas (AR SIT)

Massachusetts (MA SIT)

Minnesota (MN SIT)

Rhode Island (RI SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2020 2019

None

If you are not ready to reconfigure your employees for 2020 W-4s, please click here to install the January 31, 2020 Payroll Tax Update which includes the state changes below and FIT for 2019 or previous W-4s.

Federal

Please scroll down to the January 16, 2020 Payroll Tax Update section or click here for instructions on reconfiguring employees. You will not be able to run After the fact payroll or do Employee Adjustments for 2019 once you install this Payroll Tax Update.

State Forms

Oklahoma Electronic Filing W-2s adjustment

State and Local Income Tax

California SDI

Illinois (IL SIT)

Oregon (OR SIT)

Maryland (MD CIT)

The following Maryland counties have new rates:

New Mexico (NM SIT) - New Mexico has added an additional filing status for Head of Household. You may need to reconfigure employees that have selected this filing status on their W-4.

In addition to this change, New Mexico withholding will no longer be reduced by the number of allowances claimed. No action is required for this change as the new calculation will exclude whatever number is currently entered in the 'Allowances claimed' box. If you would like more information about this, please visit the New Mexico Taxation and Revenue Department website.

Federal

Support for 2019 Federal Form 940

Support for 2019 Federal Form 940 Schedule A

Federal Wage Base increases to $137,700 for 2020

State Forms

None

State and Local Income Tax

California (CA SIT)

Iowa (IA SIT)

Kentucky (KY SIT)

Maine (ME SIT)

Michigan (MI SIT)

Missouri (MO SIT)

North Carolina (NC SIT)

New York State (NY SIT)

New York Yonkers (Yonkers IT)

Ohio (OH SIT)

South Carolina (SC SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2020 2019

AR SUTA 7,000 10,000

IA SUTA 31,600 30,600

KY SUTA 10,800 10,500

LA SUTA 7,700 7,700

MN SUTA 35,000 34,000

MO SUTA 11,500 12,000

MT SUTA 34,100 33,000

NJ SUTA 35,300 34,400

NM SUTA 25,800 24,800

NV SUTA 32,500 31,200

NY SUTA 11,600 11,400

OH SUTA 9,000 9,500

OK SUTA 18,700 18,100

OR SUTA 42,100 40,600

UT SUTA 36,600 35,300

VT SUTA 16,100 15,600

WA SUTA 52,700 49,800

WY SUTA 26,400 25,400

Federal

Support for 2019 Federal Form W2

Support for 2019 Federal W2 Electronic Filing

Support for 2019 Federal Form 1096

Support for 2019 Federal Form 1099

Support for 2019 Federal Form 944

State Forms

Support for Arizona W2 Electronic Filing

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State Forms

None

State and Local Income Tax

Minnesota (MN SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State Forms

None

State and Local Income Tax

Idaho (ID SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State Forms

Indiana Quarterly Wage Reporting Electronic Filing - Install this Tax Update and the Software Upgrade 7.4.02 to correct issues related to the previous Tax Update for Indiana Quarterly Wage Reporting.

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State Forms

Reversal - Indiana SUTA Electronic Filing - An error occurs when Calculating Payroll for Indiana employees in certain situations which are currently being investigated. If you installed the April 17, 2019 Tax Update and encountered this error, please install this Tax Update to resolve the issue. You will need to reconfigure your employees in Payroll/Configure/Employees before running Calculate Payroll. Contains all current tax changes except the Indiana Wage Report.

We are still working on resolving this issue. An alternative way to file your Quarterly Wage Report is to visit https://uplink.in.gov/ESS/ESSLogon.htm and log in. Go to Summary, download the Wage Report Summary for the 4th quarter of 2018 (previous quarter), update the data to reflect the amounts and other pertinent information for Q1 2019, then save and upload the edited file.

Added User Defined Tax option for Lake County, Indiana. Please define the tax in Payroll/Configure/Tax Calculations before assigning it to your employees.

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State Forms

Indiana SUTA Electronic Filing

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Effective 2019

Federal

None

State Forms

California DE9 Printout

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Effective 2019

Federal

Form 941 for 2019

Form 941 Schedule B for 2019

State Forms

None

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Effective January 1, 2019

Federal

None

State Forms

West Virginia W-2 Electronic Filing

State and Local Income Tax

Alabama (AL SIT)

Colorado (CO SIT)

New Jersey (NJ SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2018 |

2019 |

|---|---|---|

| HI SUTA | 45,900 |

46,800 |

Effective January 1, 2019

Federal

None

State Forms

North Carolina W-2 Electronic Filing

South Carolina W-2 Electronic Filing

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

None

Effective January 1, 2019

Federal

Prior year adjustments

State Forms

California DE9

State and Local Income Tax

None

SUTA Wage Base (Maximum taxable earnings)

NoneEffective January 1, 2019

Federal

None

State Forms

None

State and Local Income Tax

Illinois (IL SIT)

Maryland (Caroline County)

Michigan (MI SIT)

Ohio (OH SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2018 |

2019 |

|---|---|---|

| ID SUTA | 38,200 |

40,000 |

| KY SUTA | 10,200 |

10,500 |

| ND SUTA | 35,500 |

36,400 |

| RI SUTA | 23,000 or 24,500 |

23,600 or 25,100 |

| VT SUTA | 17,600 |

15,600 |

Effective January 1, 2019

Federal

2019 Federal Withholding Tax

SSA Maximum Taxable Earnings - $132,900

State Forms

Pennsylvania W-2 Specifications for 2018

State and Local Income Tax

California (CA SIT)

California SDI taxable wage limit - $118,371

Georgia (GA SIT)

Iowa (IA SIT)

Kentucky (KY SIT)

Maine (ME SIT)

Massachusetts (MA SIT)

Mississippi (MS SIT)

Missouri (MO SIT)

New York (NY SIT)

North Carolina (NC SIT)

North Dakota (ND SIT)

Oregon (OR SIT)

Rhode Island (RI SIT)

South Carolina (SC SIT)

Yonkers (Yonkers SIT)

SUTA Wage Base (Maximum taxable earnings)

As of December 20, 2018

State |

2018 |

2019 |

|---|---|---|

| AL SUTA | 8,000 |

8,000 |

| AK SUTA | 39,500 |

39,900 |

| AR SUTA | 10,000 |

10,000 |

| AZ SUTA | 7,000 |

7,000 |

| CA SUTA | 7,000 |

7,000 |

| CO SUTA | 12,600 |

13,100 |

| CT SUTA | 15,000 |

15,000 |

| DE SUTA | 16,500 |

16,500 |

| FL SUTA | 7,000 |

7,000 |

| GA SUTA | 9,500 |

9,500 |

| HI SUTA | 38,800 |

46,900 |

| IA SUTA | 29,900 |

30,600 |

| ID SUTA | 38,200 |

37,800 |

| IL SUTA | 12,960 |

12,960 |

| IA SUTA | 25,300 |

30,600 |

| IN SUTA | 9,500 |

9,500 |

| KS SUTA | 14,000 |

14,000 |

| KY SUTA | 10,200 |

10,200 |

| LA SUTA | 7,700 |

7,700 |

| MA SUTA | 15,000 |

15,000 |

| MD SUTA | 8,500 |

8,500 |

| ME SUTA | 12,000 |

12,000 |

| MI SUTA | Assigned |

9,000 or 9,500 |

| MN SUTA | 32,000 |

34,000 |

| MO SUTA | 12,500 |

12,000 |

| MS SUTA | 14,000 |

14,000 |

| MT SUTA | 32,000 |

33,000 |

| NC SUTA | 23,500 |

24,300 |

| ND SUTA | 35,500 |

35,100 |

| NE SUTA | 9,000 |

9,000 |

| NH SUTA | 14,000 |

14,000 |

| NJ SUTA | 33,700 |

34,400 |

| NM SUTA | 24,200 |

24,800 |

| NV SUTA | 30,500 |

31,200 |

| NY SUTA | 11,100 |

11,400 |

| OH SUTA | 9,500 |

9,500 |

| OK SUTA | 17,600 |

18,100 |

| OR SUTA | 39,300 |

40,600 |

| PA SUTA | 10,000 |

10,000 |

| PR SUTA | NA |

7,000 |

| RI SUTA | 23,000 or 24,500 |

22,400 or 23,900 |

| SC SUTA | 14,000 |

14,000 |

| SD SUTA | 15,000 |

15,000 |

| TN SUTA | 7,000 |

8,000 |

| TX SUTA | 9,000 |

9,000 |

| UT SUTA | 34,300 |

35,300 |

| VA SUTA | 8,000 |

8,000 |

| VT SUTA | 17,600 |

17,300 |

| WA SUTA | 47,300 |

49,800 |

| WI SUTA | 14,000 |

14,000 |

| WV SUTA | 12,000 |

12,000 |

| WY SUTA | 24,700 |

25,400 |

December 1, 2018 Payroll Tax Table Update

Federal

Support for 2018 W-2 and W-3

Support for 2018 1096 and 1099

Support for 2018 Electronic Filing W-2

Support for 2018 Form 944

Support for 2018 Form 940 and 940sa

State and Local

Support for Oregon W-2

SUTA Wage Base (Maximum taxable earnings)

None

Effective September 1, 2018

Federal

None

State and Local

New Jersey (NJ SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

Missouri

Utah

You will need to reconfigure your employees to implement these changes. After you have installed this update, go to Payroll/Configure/Employees and select each employee and click OK. You don't have to make any changes to their data, just hit OK for each one and save your changes.

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

Kentucky SIT - You will need to reconfigure your employees to implement these changes. After you have installed this update, go to Payroll/Configure/Employees and select each employee and click OK. You don't have to make any changes to their data, just hit OK for each one and save your changes.

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

Idaho

Illinois

Louisiana

Michigan

New Mexico

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

California DE9 2018 Printable Form internal adjustment

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

Oregon Statewide Transit Tax - On July 1, 2018, employers must start withholding the tax (one-tenth of 1 percent or .001). After installing this Tax Update, go to Payroll/Configure/Taxes and create a new tax. In the Name pull-down menu, select OR PTT and fill in the appropriate information for this tax. Assign this new tax to all appropriate employees in Payroll/Configure/Employees or you can use Payroll/Configure/Global Employee Update to assign to all selected employees at once.

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

North Dakota (ND SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

Support for California DE9 2018

New procedures for filing:

SUTA Wage Base (Maximum taxable earnings)

None

Federal

Support for Federal Form 941

Support for Federal Form 941 Schedule B

State and Local

Minnesota (MN SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Federal

None

State and Local

Oregon (OR SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Federal

2018 Federal Withholding Tax

State and Local

Mississippi (MS SIT)

SUTA Wage Base (Maximum taxable earnings)

None

Pennsylvania Employee SUTA rate .06%

Federal

Social Security Maximum Taxable Earnings - $128,400

State and Local

California (CA SIT)

California SDI

Kentucky (KY SIT)

Maine (ME SIT)

Maryland, Cecil County (MD CIT)

New York (NY SIT)

New York City (NYC CIT)

New York Yonkers (YNK CIT)

Rhode Island (RI SIT)

South Carolina (SC SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2018 |

2017 |

|---|---|---|

| AL SUTA | 8,000 |

8,000 |

| AK SUTA | 39,500 |

39,800 |

| AR SUTA | 10,000 |

12,000 |

| AZ SUTA | 7,000 |

7,000 |

| CA SUTA | 7,000 |

7,000 |

| CO SUTA | 12,600 |

12,500 |

| CT SUTA | 15,000 |

15,000 |

| DE SUTA | 16,500 |

18,500 |

| FL SUTA | 7,000 |

7,000 |

| GA SUTA | 9,500 |

9,500 |

| HI SUTA | 38,800 |

34,200 |

| IA SUTA | 29,900 |

29,300 |

| ID SUTA | 38,200 |

37,800 |

| IL SUTA | 12,960 |

12,960 |

| IA SUTA | 25,300 |

24,700 |

| IN SUTA | 9,500 |

9,500 |

| KS SUTA | 14,000 |

14,000 |

| KY SUTA | 10,200 |

10,200 |

| LA SUTA | 7,700 |

7,700 |

| MA SUTA | 15,000 |

15,000 |

| MD SUTA | 8,500 |

8,500 |

| ME SUTA | 12,000 |

12,000 |

| MI SUTA | Assigned |

9,000 or 9,500 |

| MN SUTA | 32,000 |

32,000 |

| MO SUTA | 12,500 |

13,000 |

| MS SUTA | 14,000 |

14,000 |

| MT SUTA | 32,000 |

31,400 |

| NC SUTA | 23,500 |

23,100 |

| ND SUTA | 35,500 |

35,100 |

| NE SUTA | 9,000 |

9,000 |

| NH SUTA | 14,000 |

14,000 |

| NJ SUTA | 33,700 |

33,500 |

| NM SUTA | 24,200 |

24,300 |

| NV SUTA | 30,500 |

29,500 |

| NY SUTA | 11,100 |

10,900 |

| OH SUTA | 9,500 |

9,000 |

| OK SUTA | 17,600 |

17,700 |

| OR SUTA | 39,300 |

38,400 |

| PA SUTA | 10,000 |

9,750 |

| PR SUTA | NA |

7,000 |

| RI SUTA | 23,000 or 24,500 |

22,400 or 23,900 |

| SC SUTA | 14,000 |

14,000 |

| SD SUTA | 15,000 |

15,000 |

| TN SUTA | 7,000 |

8,000 |

| TX SUTA | 9,000 |

9,000 |

| UT SUTA | 34,300 |

33,100 |

| VA SUTA | 8,000 |

8,000 |

| VT SUTA | 17,600 |

17,300 |

| WA SUTA | 47,300 |

45,000 |

| WI SUTA | 14,000 |

14,000 |

| WV SUTA | 12,000 |

12,000 |

| WY SUTA | 24,700 |

25,400 |

Federal

Support for 2017 W-2 and W-3

Support for 2017 1096 and 1099

Support for 2017 Electronic Filing W2

Support for 2017 940

Support for 2017 944

When printing W2s, W3s, 1096s, and 1099s on pre-printed forms, some printers may cause alignment issues with your printouts. We recommend checking the alignment of the form by printing on plain paper and comparing the alignment with your preprinted forms before printing on the actual forms. If you need to make adjustments to your printout, please click here for instructions.

State and Local

Magnetic Media for Missouri

Magnetic Media for Iowa

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Effective Immediately

Federal

None

State and Local

Maine (ME SIT)

New York City (NYC CIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Effective July 1, 2017

Federal

None

State and Local

Idho (ID SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Effective July 1, 2017

Federal

None

State and Local

Illinois (IL SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Federal

None

State and Local

Kansas (KS SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Federal

2017 941

2017 941 Schedule B

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Federal

None

State and Local

Colorado (CO SIT)

Maine (ME SIT)

Missouri (MO SIT)

North Dakota (ND SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

None

Federal

2017 Federal Withholding Tax

2017 SSA Taxable Wage Base $127,200

State and Local

California (CA SIT)

California (CA SDI)

Indiana (IN SIT)

Kentucky (KY SIT)

Maryland (MD SIT)

Minnesota (MN SIT)

Nebraska (NE SIT)

New Mexico (NM SIT)

New York State (NY SIT)

New York Yonkers (YONKERS CIT)

North Carolina (NC SIT)

Oklahoma (OK SIT)

Oregon (OR SIT)

Rhode Island (RI SIT)

South Carolina (SC SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2017

------------------------------------------

AK SUTA 39,700 39,800

CO SUTA 12,200 12,500

HI SUTA 42,200 44,000

IA SUTA 28,300 29,300

ID SUTA 37,200 37,800

MN SUTA 31,000 31,400

MT SUTA 30,500 32,000

NV SUTA 28,200 29,500

NJ SUTA 32,600 33,500

NM SUTA 24,100 24,300

NY SUTA 10,700 10,900

NC SUTA 22,300 23,100

ND SUTA 37,200 35,100

OK SUTA 17,500 17,700

OR SUTA 36,900 38,400

PA SUTA 9,500 9,750

RI SUTA 22,000 or 23,500 22,400 or 23,900

UT SUTA 32,200 33,100

VT SUTA 16,800 17,300

WA SUTA 44,000 45,000

WY SUTA 25,500 25,400

Federal

W2 and W3 for 2016

1099 and 1096 for 2016

944 for 2016

940 and 940 SA 2016

2016 W2 Electronic Filing

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

None

Effective June 2016

Federal

None

State and Local

Idaho (ID SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

None

Effective January 1, 2016

Federal

2016 941

2016 941 Schedule B

State and Local

Connecticut (CT SIT) Correction in Recapture Amount for highly paid employees

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

Tennessee 8000 9000

Effective January 1, 2016

Federal

None

State and Local

Connecticut (CT SIT)

Oregon (OR SIT) minor table value update

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

None

Effective January 1, 2016

Federal

None

State and Local

Washington DC (DC SIT)

Missouri (MO SIT)

North Dakota (ND SIT)

Oregon (OR SIT)

Rhode Island (RI SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

None

Effective January 1, 2016

Federal

None

State and Local

California SDI

Illinois (IL SIT)

Massachusetts (MA SIT)

North Carolina (NC SIT)

Oklahoma (OK SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

None

Effective January 1, 2016

Federal

US FIT

State and Local

California (CA SIT)

Kentucky (KY SIT)

Maine (ME SIT)

Maryland (MD SIT) Anne Arundel, Worcester Counties

Minnesota (MN SIT)

New Mexico (NM SIT)

New York State (NY SIT)

New York Yonkers (YONKERS CIT)

SUTA Wage Base (Maximum taxable earnings)

State 2016 2015

------------------------------------------

AK SUTA 39,700 38,700

CO SUTA 12,200 11,800

HI SUTA 42,200 40,900

IA SUTA 28,300 27,300

ID SUTA 37,200 36,000

KS SUTA 14,000 12,000

KY SUTA 10,200 9,900

MN SUTA 31,000 30,000

MT SUTA 30,500 29,500

NV SUTA 28,200 27,800

NJ SUTA 32,600 32,000

NM SUTA 24,100 23,400

NY SUTA 10,700 10,500

NC SUTA 22,300 21,700

ND SUTA 37,200 35,600

OK SUTA 17,500 17,000

OR SUTA 36,900 35,700

PA SUTA 9,500 9,000

RI SUTA 22,000 or 23,500 21,200 or 22,700

UT SUTA 32,200 31,300

VT SUTA 16,800 16,400

WA SUTA 44,000 42,100

WY SUTA 25,500 24,700

Federal

Support for 2015 W-2 Plain Paper 4-UP

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Federal

Support for 2015 W-2 and W-3

Support for 2015 940 and 944

Support for 2015 1099 and 1096

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective October 30, 2015

Modifications to Payroll Hours of Service Report:

For detailed information, click here.

Effective August 31, 2015

Federal

None

State and Local

Connecticut (CT SIT)

Idaho (ID SIT)

Ohio (OH SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective June 1, 2015

Federal

None

State and Local

New York City (NYC CIT)

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective January 1, 2015

Federal

2015 941 Changes (PDF Support requires Tax Form Kit)

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective January 1, 2015

Federal

None

State and Local

Washington, D.C. (DC IT)

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective January 1, 2015

Federal

None

State and Local

Illinois (IL SIT)

Indiana (IN SIT)

Missouri (MO SIT)

North Carolina (NC SIT)

North Dakota (ND SIT)

New Mexico (NM SIT)

Oklahoma (OK SIT)

Oregon (OR SIT)

Rhode Island (RI SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective January 1, 2015

Federal

None

State and Local

California SDI rate change

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

None

Effective January 1, 2015

Federal

Support for 2014 940, 940 Schedule A, and 944 PDF Forms (requires Tax Form Kit)

US FIT

US SS Wage limit is $118,500. Rates remain unchanged

State and Local

Arkansas (AR SIT)

California (CA SIT)

Connecticut (CT SIT)

Kansas (KS SIT)

Kentucky (KY SIT)

Massachusetts (MA SIT)

Maryland (MD- Electronic W-2 file format (RV record))

Maine (ME SIT)

Minnesota (MN SIT)

New York (NY SIT)

New York Yonkers (YONKERS CIT)

SUTA Wage Base (Maximum taxable earnings)

State 2015 2014

------------------------------------------------------------

AK SUTA 38,700 37,400

CO SUTA 11,800 11,700

FL SUTA 7,000 8,000

HI SUTA 40,900 40,400

IA SUTA 27,300 26,800

ID SUTA 36,000 35,200

KS SUTA 12,000 8,000

KY SUTA 9,900 9,600

MA SUTA 15,000 14,000

MN SUTA 30,000 29,000

MT SUTA 29,500 29,000

NV SUTA 27,800 27,400

NJ SUTA 32,000 31,500

NY SUTA 10,500 10,300

NC SUTA 21,700 21,400

ND SUTA 35,600 33,600

OK SUTA 17,000 18,700

OR SUTA 35,700 35,000

PA SUTA 9,000 8,750

RI SUTA 21,200 or 22,700 20,600 or 22,100

SC SUTA 14,000 11,000

SD SUTA 15,000 14,000

UT SUTA 31,300 30,800

VT SUTA 16,400 13,000

WA SUTA 42,100 41,300

WY SUTA 24,700 24,500

Federal

Support for 2014 tax year 1096, 1099, W2 and W3 forms and electronic file

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective July 1, 2014

Federal

None

State and Local

CA Support for updated DE9 PDF form (requires Tax Form Kit)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective August 1, 2014

Federal

None

State and Local

NY Yonkers (Yonkers CIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective July 1, 2014

Federal

None

State and Local

Idaho (ID SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective July 1, 2014

Federal

None

State and Local

Ohio (OH SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective April 1, 2014 - If you have additional payrolls to process for March, do not install this update until April 1, 2014.

Federal

None

State and Local

Wisconsin (WI SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective February 1, 2014

Federal

Federal Form 941 for 2014

Federal Form 941 Schedule A for 2014

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective January 1, 2014

Federal

None

State and Local

Michigan (MI SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

None

Effective January 1, 2014

Federal

None

State and Local

Connecticut (CT SIT)

Illinois (IL SIT)

Kansas (KS SIT)

Massachusetts

(MA SIT)

Maine (ME SIT)

Missouri (MO SIT)

North Dakota (ND SIT)

Oklahoma (OK SIT)

Oregon (OR SIT)

Rhode Island (RI SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

AK SUTA 37,400 36,900

HI SUTA 40,400 39,600

IA SUTA 26,800 26,600

ID SUTA 35,200 34,800

KY SUTA 9,600 9,300

NC SUTA 21,400 20,900

ND SUTA 33,600 31,800

NV SUTA 27,400 26,900

NY SUTA 10,300 8,500

WY SUTA 24,500 23,800

Effective January 1, 2014

Federal

Support for 2014 944 PDF Form (requires Tax Form Kit)

US FIT

US SS Wage limit is $117,000. Rates remain unchanged.

State and Local

California (CA SDI)

California (CA SIT)

Delaware (DE SIT)

Kentucky (KY SIT)

Maryland (MD SIT - Caroline, Carroll, and Charles counties)

Minnesota (MN SIT)

North Carolina (NC SIT)

New Mexico (NM SIT)

New York (NY SIT)

New York, Yonkers (YONKERS CIT)

SUTA Wage Base (Maximum taxable earnings)

State 2014 2013

------------------------------------------------------------------------

CO SUTA 11,700 11,300

DE SUTA 18,500 10,500

IL SUTA 12,960 12,900

MT SUTA 29,000 27,900

NJ SUTA 31,500 30,900

NM SUTA 23,400 21,900

OK SUTA 18,700 20,100

OR SUTA 35,000 34,100

PA SUTA 8,750 8,500

RI SUTA 22,100 or 20,600 21,700 or 20,200

SD SUTA 14,000 13,000

UT SUTA 30,800 30,300

WA SUTA 41,300 39,800

Federal

Support for 2013 W2s

Support for 2013 940 and 940 Schedule A - Requires Pervasive database version 10 or 11

Earnings Report - Correct earnings subject to Medicare for earnings over $200,000

1099

1096

State and Local

None

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

None

State and Local

Ohio (OH SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

Improved reporting of Additional Medicare Tax on Earnings Report

State and Local

Support for Pennsylvania W-2 Electronic Filing

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

None

State and Local

North Dakota (ND SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective June 20, 2013

Federal

None

State and Local

Minnesota (MN SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

None

State and Local

Idaho (ID SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

Federal Form 941 for 2013

State and Local

Mississippi W2 Electronic Filing - RS record format change

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

None

State and Local

Missouri (MO SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

None

State and Local

New Mexico (NM SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State 2013 2012

------------------------------------------------------------

None

Effective January 1, 2013

Federal

None

State and Local

Colorado (CO SIT)

Connecticut (CT SIT)

Illinois (IL SIT)

Maryland (MD SIT)

Oklahoma (OK SIT)

Oregon (OR SIT)

Direct Deposit – Direct Deposit advice numbers were incorrectly assigned. This has been fixed.

940 Schedule A - State FUTA wages were calculated incorrectly in some multiple department situations. This has been fixed.

Effective January 1, 2013

Federal

US FIT

State and Local

Georgia (GA SIT)

Rhode Island (RI SIT)

PA SUTA W-2 reporting of employee contributions

Effective January 1, 2013

FederalCalifornia (CA SDI)

California (CA SIT)

Kansas (KS SIT)

Kentucky (KY SIT)

Maine (ME SIT)

Minnesota (MN SIT)

North Dakota (ND SIT)

Nebraska (NE SIT)

New York (NY SIT)

YONKERS CIT

Effective December 1, 2012

FederalEffective December 1, 2012

FederalEffective October 1, 2012

FederalEffective January 1, 2012

FederalEffective January 1, 2012

Federal| State | 2012 | 2011 |

|---|---|---|

FL SUTA |

8,000 |

8,500 |

Effective January 1, 2012

Effective January 1, 2012

SUTA Wage Base (Maximum taxable earnings)

State |

2012 |

2011 |

|---|---|---|

| MI SUTA | 9,500 |

9,000 |

Effective January 1, 2012

Install this update after the last payroll run in 2011 and before the first payroll in 2012.

SUTA Wage Base (Maximum taxable earnings)

State |

2012 |

2011 |

|---|---|---|

| AK SUTA | 35,800 |

34,600 |

| CO SUTA | 11,000 |

10,000 |

| FL SUTA | 8,500 |

7,000 |

| HI SUTA | 38,800 |

34,200 |

| ID SUTA | 34,100 |

33,300 |

| IL SUTA | 13,560 |

12,740 |

| IA SUTA | 25,300 |

24,700 |

| KY SUTA | 9,000 |

8,000 |

| MN SUTA | 28,000 |

27,000 |

| MT SUTA | 27,000 |

26,300 |

| NC SUTA | 20,400 |

19,700 |

| NV SUTA | 26,400 |

26,600 |

| NH SUTA | 14,000 |

12,000 |

| NJ SUTA | 30,300 |

29,600 |

| NM SUTA | 22,400 |

21,900 |

| ND SUTA | 27,900 |

25,500 |

| OK SUTA | 19,100 |

18,600 |

| OR SUTA | 33,000 |

32,300 |

| RI SUTA | 21,100 or 19,600 |

19,000 |

| SC SUTA | 12,000 |

11,000 |

| SD SUTA | 12,000 |

11,000 |

| UT SUTA | 29,500 |

28,600 |

| VT SUTA | 16,000 |

13,000 |

| WA SUTA | 38,200 |

37,300 |

| WY SUTA | 23,000 |

22,300 |