DOWNLOAD

21st Century Accounting Software Upgrades

Please backup your company data or make a copy of your C21/data folder before installing.

Please provide your name, email address, and 21st Century Accounting Product serial number to download the latest software upgrades. This upgrade is available only for registered users of 21st Century Accounting who have a current subscription for software upgrades.

Fill out the form and click send to proceed to the download page. All fields are required.

If you are unable to download the software upgrade, you may need to renew your subscription. Please go to, Our Products/Software to renew.

21st Century Accounting Software Upgrades

21st Century Accounting Version 8.8.01

This 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting.

Support for 2024 Pre-printed Forms

Support for Office Depot 2024 Form 1099-NEC

Support for Dynamic Systems Pre-printed 2024 Form 1099-NEC

Support for Blue Summit (Amazon) Pre-printed 2024 Form 1099-NEC

Support for Federal 1099-MISC and 1096, customize as required

Changes can be made to form 1099-NEC but should not be saved. Changes can be saved for the 1099-MISC.

21st Century Accounting Version 8.7.04

This 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting.

Support for 2023 Pre-printed Forms

Amazon Blue Summit 1099-MISC

Amazon Blue Summit 1099-NEC

Dynamic Systems

1099-MISC

Dynamic Systems 1099-NEC

Office Depot 1099-MISC

Office Depot 1099-NEC

Changes can be made to form 1099-NEC but should not be saved. Changes can be saved for the 1099-MISC.

Problems Fixed - The Receipts Journal was including all accounts instead of selected accounts even with that parmater selected. This problem has been fixed.

21st Century Accounting Version 8.6.17

This 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting.

1099-MISC and 1099-NEC - Due to customer request, we have returned Box 7 as an option to select in Payables/Configure/Vendors "Report on 1099". If your Vendors were previously configured for Box 7, this upgrade will return the Vendor setup as it was. Please note that there is not an amount that goes in Box 7 on the 1099-NEC or the 1099-MISC. If you have Box 7 entered it will go in Box 1 on the 1099-NEC.

Please note Deluxe Tax Forms are no longer supported.

NOTE: This upgrade contains some adjustments to the 1099-NEC layout for Pre-printed forms. If you worked with a technician or received an adjustment file from us, this upgrade will replace those files. If you would like to keep your forms as they are, copy the following files to a safe location from your C21/Reports folder:

ap1099necamazon.tcl

ap1099necdynamicsystems.tcl

ap1099necofficedepot.tcl

After installation is complete, return the files to the C21/Reports folder and replace the new files from this upgrade. If you require assistance, please send us a Problem Report in Help/Submit Problem Report.

If you do not see the options for the various forms in the Payables/Print menu, please install your Tax Table.

21st Century Accounting Version 8.5.15

The 8.5.15 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting. Installing the Upgrade will bring your 21st Century Accounting to the 8.5.15 version level.

1099-MISC and 1099-NEC - Box 7 had been removed in Version 8.5.14 since it is no longer supported. Version 8.5.15 puts the box back so you do not need to update your Vendors if you are printing 1099-NECs as any Box selection puts the amount in Box 1 on the 1099-NEC.

21st Century Accounting Version 8.5.14

The 8.5.14 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting. Installing the Upgrade will bring your 21st Century Accounting to the 8.5.14 version level.

Support for 1099-MISC 2022 Forms

Changes to many of the 1099-MISC forms for 2022 require that the year 2022 be printed on the form. If the year is in the incorrect location on your form, activate the Report Customizer in the System menu. Then preview the form and use the red guidelines to move the year where you need it.

Please reply to this email if you require assistance with your form adjustments.

Support for 1099-NEC 2022 Forms

Select the appropriate form in the Payables/Print menu.

2022 Office Depot Forms

2022 Amazon Forms

2022 Dynamic Systems Forms

Please reply to this email if you require assistance with your form adjustments.

PLEASE NOTE: For 1099-NEC Forms, if adjustments are made, print the forms after adjustments are made. Saving your changes will require you to re-install this upgrade and you will lose your changes.

Receive Credit Card Payments - Additional fix for Receive Credit Card Payments module error.

21st Century Accounting Version 8.2.01

The 8.1.03 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting. Installing the Upgrade will bring your 21st Century Accounting to the 8.1.03 version level.

Problems Fixed in 8.2.01

Receive Credit Card Payments - Additional fix for Receive Credit Card Payments module error.

Enhancements in 8.1.03

Direct Deposit - Some banks require a specific letter or number in front of the Immediate origin ID in the NACHA file for upload. A new box, 'Immediate origin ID prefix,' is now provided directly beneath the Immediate origin ID in Payroll/Configure/Company Information a specific digit or letter is required. If you leave the box blank, a '1' will be recorded in the prefix space.

1099-NEC - For tax year 2021, the IRS has redesigned Form 1099-NEC to three forms per page rather than two forms as in 2020. You will now see three sections for 1099-NEC recipients per form but you may need to make adjustments based on the pre-printed form you are using. Check System/Customize Reports and Forms and then Preview the form in Payables/Print/1099-NEC to make these adjustments before printing on your actual forms. Right-click to show all guide lines. Print out your 1099-NEC with the adjustments on blank paper against your pre-printed form to be sure that all data lines up correctly. DO NOT SAVE YOUR CHANGES. You cannot save the changes you make to this form. If you need assistance with this process, please send us a Problem Report from the Help menu and enter the type of form and the supplier in the description box. We will also need your company data which can be sent from Help/Send Company Data to 21st Century Accounting.

Receive Credit Card Payments - A bug existed in the Sales/Receive Credit Card Payments module that prevented discounts from posting to associated Discount GL accounts. This bug was not rectifiable so the Discounts option has been removed from the module.

Help - Additional Help items added.

21st Century Accounting Version 8.0.05

The 8.0.05 21st Century Accounting Upgrade can be installed on both the US and Canadian versions of 21st Century Accounting. Installing the Upgrade will bring your 21st Century Accounting to the 8.0.05 version level.

Enhancements in 8.0.05

1099-NEC - If you have vendors set up to be recorded on a 1099, you will also be able to produce the data for the 1099-NEC. Box 1 of the 1099-NEC is supported and will be filled in regardless of which 1099 Box you have elected in Payables/Configure/Vendors. To produce the data for Box 1 on your pre-ordered 1099-NEC form, go to Payables/Print/1099 NEC. If you need to adjust the placement of the Box 1 amount to suit your pre-ordered forms, check Customize Reports and Forms in the System menu. When you preview the form in 1099 NEC, you can move the blue lines to adjust the placement.

2020 Form 1096 - Changes to the 1096 for 2020 include the addition of a box designated 1099-NEC (71) for Vendors that require the Form 1099-NEC. C21 does not support more than one box on the 1096, however, there is a workaround for the 1099-NEC Box on the 1096.

- Go to System and check 'Customize Reports and Forms.'

- In Payables/Print/1099 Payments, preview or print a report for the year to see which Box is checked for your Vendors.

- In Payables/Print/1096s, select the Vendors that required the 1099-NEC form (Box 7 with this update). Click Browse next to Selected Vendors and check any Vendors that required this form. See the 1099 Payments report if you are unsure.

- Click Preview.

- If you hover over the X that would normally go in the 1099-MISC Box, you will see blue lines appear that turn red when you click on them. Click the lines and drag the X over so that it will line up inside the 1099-NEC box on whatever preprinted form you are using. We recommend that you print it out on a blank piece of paper and line it up before printing on your form. When you close out of the Preview, if you do not save, the X will return to the original position.

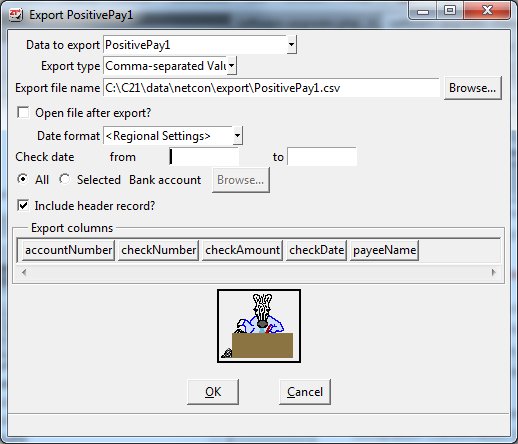

- In the 'Data to export' box, use the pull-down arrow to select either PositivePay1 or PositivePay10. Both of these exports include the Account Number, Check Number, Check Amount, Check Date, and Payee Name for any checks that have not been reconciled. The PositivePay10 export pads the account number to make 10 digits.

- Select the 'Export type', either CSV or Tabbed.

- The Export file name will be automatically filled in. If you wish to change this location, browse to the location of your choice.

- You must enter a Check Date range to produce the file and select either All or a specific bank account.

- Click OK to produce the file which can be found at the location indicated. If you wish to rearrange items in the CSV file, open the file in excel and rearrange the columns as needed.

C21 Help - Added help for 2020 Federal Income Tax (FIT) changes.

1099-MISC - Changes have been made to the 1099 - MISC. The following table shows how the changes correspond to Box selections for 2020.

| 2019 | 2020 | Name | Supported? |

|---|---|---|---|

| Box 1 | Box 1 | Rents | Yes |

| Box 2 | Box 2 | Royalties | Yes |

| Box 3 | Box 3 | Other Income | Yes |

| Box 4 | Box 4 | Federal income tax withheld | No |

| Box 5 | Box 5 | Fishing boat proceeds | Yes |

| Box 6 | Box 6 | Medical and health care payments | Yes |

| Box 7 | Nonemployee Compensation | See 1099-NEC | |

| Box 8 | Box 8 | Substitute payments in lieu... | No |

| Box 9 | Box 7 | Payer made directs sales of $5000 ... | No |

| Box 10 | Box 9 | Crop insurance proceeds | Yes |

| Box 11 | Box 11 | Blank | |

| Box 12 | Box 12 | Section 409A deferrals | Yes |

| Box 13 | Box 13 | Excess golden parachute payments... | Yes |

| Box 14 | Box 10 | Gross proceeds paid to an attorney | Yes |

| Box 15a | Blank | Blank | |

| Box 15b | Box 14 | Nonqualified deferred compensation | Yes |

Positive Pay - You can now export a CSV file to accommodate Positive Pay banking requirements. To access these exports, go to System/Company/Export/Custom.

Download all changes since 2.0.0: Click Here

To view a list of past changes click here.

Keep your software up to date!

We strongly recommend that you install this 21st Century Accounting Upgrade whether or not the issues addressed apply to you. Enhancements and fixes to the software contribute to its overall robustness. For certain support issues, 21st Century Accounting technical support technicians will not be able to provide support unless you are running on the latest version of the software.