21st Century Accounting Tutorials - Bank Accounts

Configure Bank Accounts

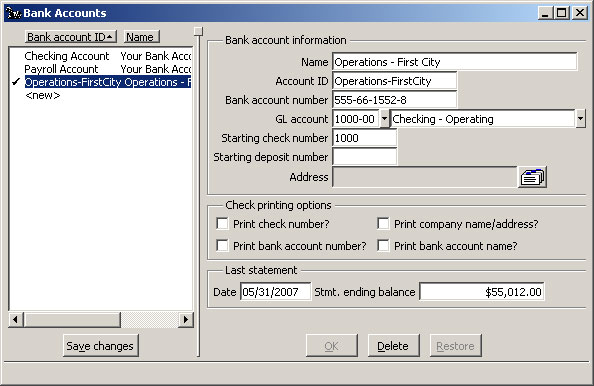

You use the Bank Accounts/Configure/Bank Accounts window to associate each of your bank accounts and checkbooks with a general ledger account, to establish the bank statement's date and ending balance at the last bank reconciliation, and to set up check printing options based on whether you use preprinted checks.

Each bank account defined in 21st Century Accounting is associated with a specific G/L asset account. You can associate one or multiple bank accounts with a single G/L account, although for bank reconciliation, you will find it more efficient to assign a single bank account to each G/L account.

21st Century Accounting expects all transactions entered to general ledger accounts that you have defined as bank accounts to be bank transactions that show up on your bank statement. All 21st Century Accounting transactions that affect a bank account are displayed when you reconcile the account in Bank Accounts/Reconciliation.

Several sample bank accounts are set up in the model company. You will add a new bank account to the company you created, Arnold Plumbing.

Run System/Company/Select and select Arnold Plumbing.

Run Bank Accounts/Configure/Bank Accounts to see how to set up a bank account.

Press F9.

Name. Type Operations - First City.

The name of the bank, the checkbook, or the bank account—First City National Bank, for example—can be printed on checks and identifies the bank account on Selector lists and reports. If you keep cash in more than one account at the same bank or if you write checks from multiple checkbooks on the same account, make each name meaningful for easy recognition.

Account ID. Press Tab.

The bank account ID identifies each bank account in data entry windows and on reports. The system defaults the bank account Name.

Make each bank account ID begin with a unique character for quick entry when you are prompted for an account ID during data entry.

Bank account number. Type 555-66-1552-8.

Optionally, you can enter the account number for printing on checks and reports.

G/L Account. Select 1000 00- Checking - Operating from the drop-down list. Press Tab twice.

You must use an asset (cash equivalent) account. When you select the bank account as you enter deposits, checks, and other transactions, the system posts to the associated general ledger account you enter here.

If you intend to use bank reconciliation, you should assign each bank account a separate general ledger account.

Starting check number. Type 1000.

The system will use this number as the check number for the next check you enter on this bank account.

Starting deposit number. Press Tab to leave blank.

The system will supply a deposit number, beginning with 1.

Address. Press Tab.

You can leave the bank address blank if you wish. Press Spacebar or click the address icon if you want to enter an address.

Check printing options.

Print check number? Check this option to print 21st Century Accounting check numbers on checks.

Print company name/address? Check this option if your checks do not show the company name and address and you want the 21st Century Accounting company name and address printed on them. The name and address from General Ledger/Configure/Company will print on the checks.

Print bank account number? Check this option if your checks do not show the bank account number and you want to print the 21st Century Accounting bank account number on them.

Print bank account name? Check this option if your checks do not show the bank account name and you want to print the 21st Century Accounting bank account name on them.

Press Tab 4 times.

You check the boxes to select the check printing options that are appropriate for your check forms.

Last statement: Date. Type 053107.

During initial set up, enter the date you last reconciled the bank statement with your checkbook. Bank Reconciliation will use this date plus 30 days to default the statement date the next time you reconcile your statement for this account. When you finish a reconciliation, the statement date from the reconciliation updates this field.

Last statement: Statement ending balance. Type 55012.00.

During initial set up, enter the bank statement ending balance from the last bank reconciliation for this bank account. Bank Reconciliation uses this amount as the opening balance the next time you reconcile your statement for this account. When you finish a reconciliation, the statement ending balance from the reconciliation updates this field.

Click OK.

Your completed bank account window looks like this.

Bank Accounts: Configure Bank Accounts window

Click Save changes to commit the information to your books.

Back To Top | Back To Main Tutorials Page