21st Century Accounting Tutorials - Payroll

Configure Taxes

When you set up Payroll factors from scratch, set up Taxes factors last, after Income, Deductions, Noncash Benefits, Accruals, and Tax Calculations (which you use only if user-defined Taxes apply to the company). In this window, you assign the appropriate taxes to a company from among ALL available taxes -- either Federal and state taxes supported by the Payroll Tax Updates or user-defined taxes you created.

Of course, you can modify and add Taxes factors at any time.

For our sample tax, let's say you opened an office in Tulsa and hired some staff. Your Oklahoma employees will be paying Oklahoma state income tax. You add Oklahoma SIT and you then assign the tax to the Tulsa employees.

Run Payroll/Configure/Taxes.

In the left pane, press Tab on <new> or press F9.

Name. Select OK SIT from the drop-down list.

Auto assign. Press Tab.

You don't want to automatically assign the factor to new employees as you add them. Only a few employees will be hired in Tulsa from time to time.

Reporting ID. Enter 12-3456789, the employer identification number you use to report state taxes to Oklahoma

The EIN prints on W-2s.

Remittance vendor. Select State Comptroller from the list.

You can set up the financial institution to which you remit OK SIT as a Payables vendor and associate the tax with that vendor in the Payroll/Configure/Taxes window. You must associate the tax with a remittance vendor if you intend to use Payroll/Print/Remittance Checks.

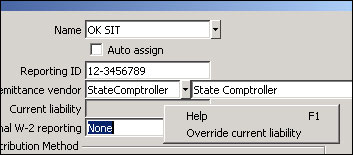

Current liability. The Current liability field is protected from accidental data entry. Right-click to edit the field and to review the Help for how the system uses this information.

As you process Payrolls for Oklahoma employees, the accumulated, unremitted current liability amount is displayed here. When you are adding a new tax, the liability is zero, since you have not yet paid any employees whose pay is subject to the tax.

As you process payrolls and submit remittances of the tax, the amount should reflect what you owe in OK SIT remittance. If this amount is incorrect, you can right-click the field and type your correct liability for this tax.

Payroll: Configure Taxes Current liability field

Additional W-2 reporting, Contribution Method, and Earnings Calculation. The Oklahoma tax tables control W-2 reporting, contribution methods, and how to determine taxable income, so these fields are for your information only.

Liability account. For this lesson, just for practice, let's select 2580-00 IL SIT Payable for posting the employee withholding.

Following the scheme in NETCON's COA, you would normally add an account to the COA for OK SIT before posting. You can change this account later, after you add the appropriate account for OK SIT to the Chart of Accounts.

Earnings include. Press the Spacebar or click the icon to open the window. You indicate which factors to include when calculating OK SIT. Make sure the Oklahoma-taxable factors are checked and click OK.

The Earnings include window lists all eligible pay factors (Incomes, Noncash Benefits, Accrual payouts, and Deductions) set up so far.

Press the OK button to save the entry.

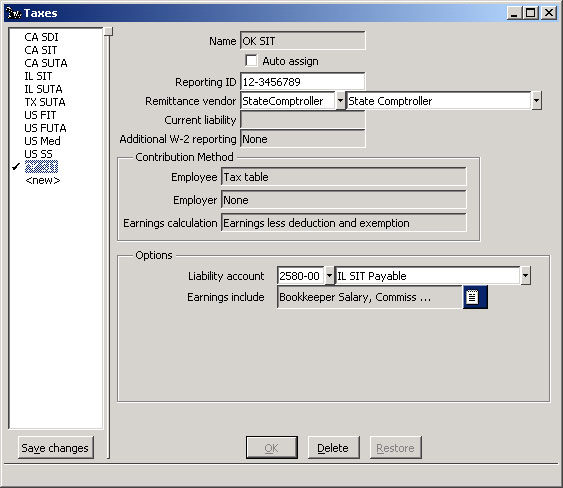

Here is how the completed Taxes window should look.

Payroll: Configure Taxes window

Press the Save changes button in the left pane to permanently record the tax you have just configured.

When you assign the tax to employees, you will enter the employee-specific information for the tax such as filing status, allowances, exemptions, and extra withholding.

When you process Payroll, the system calculates the tax amount for the employee and subtracts the amount from gross pay. For employee withholding and employer contribution, if any, the system credits the tax liability accounts. For the employer contribution, the system debits the tax expense account. And finally, the system updates the current liability shown in this window.

Back To Top | Back To Main Tutorials Page