21st Century Accounting Tutorials - Payroll

Configure Workers’ Comp. Codes

Use Configure/Workers’ Comp. Codes to set up all the Workers’ Compensation classification codes that identify the kinds of Workers’ Comp.-covered jobs assigned to your employees. You then enter the applicable WC Codes for the pay factors (WC-covered jobs) that are assigned to employees in the Configure/Employees window.

Then when you process payroll, the system records earnings associated with each of the WC-covered jobs. For each WC Code for the selected date range, the Workers’ Compensation Report shows regular hours and pay, overtime hours and pay, and total WC-covered pay for affected employees. The value in the “Premium” column is the total pay or hours associated with the WC Code multiplied by the rate.

Run System/Company/Select. Select the company NETCON.

|

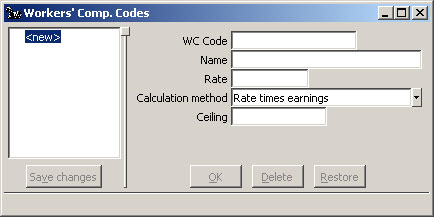

Run Payroll/Configure/Workers’ Comp. Codes. In this window you enter the WC Code, a descriptive name, the calculation method (rate times earnings or hours), the rate, and the ceiling, if any. |

Payroll: Configure Workers’ Comp. Codes window

WC Code. Identify the Workers’ Comp. Code by its official ID. This helps auditors and others who examine payrolls to determine the appropriate insurance premium, experience modifications, credits, discounts, and so forth.

Name. You can enter a name to help identify each Workers’ Compensation Code. The name might identify the kind of work associated with the code. For example, in California, you could give the name “Umbrella mfg.” to the WC Code 2501(3).

Rate. Enter the rate that is assigned to this Workers’ Comp. Code. Type the rate as you see it in your WCC documentation; for example, type a rate of 5.63 as 5.63.

Calculation method. Select a calculation method from the options, as described below. The calculation method determines how the Workers’ Compensation Report calculates the unadjusted “Premium” associated with the covered earnings or hours.

The Workers’ Comp. calculation methods work as follows:

Rate times earnings. The calculated WC “premium” on the Workers’ Compensation Report is the rate you enter in this window times the calculated earnings (up to the ceiling, if there is one) for the factors that are assigned to WC Codes that use this rate.

Rate times earnings - no overtime multiplier. The calculated WC “premium” on the Workers’ Compensation Report is the rate you enter in this window times the calculated earnings (up to the ceiling, if there is one) for the factors that are assigned to WC Codes that use this rate.

Earnings for overtime factors assigned to WC codes using this rate are calculated at the base factor rate (no Overtime multiplier).

Rate times hours. The calculated “premium” on the Workers’ Compensation Report is the rate you enter in this window times the hours worked for the factors that are assigned to WC Codes that use this rate.

Worker’s Comp. considers overtime hours to be hours worked at any pay factor for hourly income that uses the Overtime multiplier contribution method. Regardless of the Calculation method you select, all overtime hours are reported as overtime hours on WC reports.

Ceiling. Enter the ceiling, if there is a ceiling to the Worker’s Comp.-covered earnings associated with this WC Code.

The ceiling is taken into account across the transaction date range you specify when you print the report. The system does not track “earnings subject to” with and without ceiling as it does with taxes. For example, when you print the Workers’ Compensation Report from April 1st of one year to April 1st of the next, if an employee’s covered pay for that date range exceeds the ceiling, the pay is capped at the ceiling for the purpose of calculating a premium.

The Ceiling field is disabled for Rate times hours.

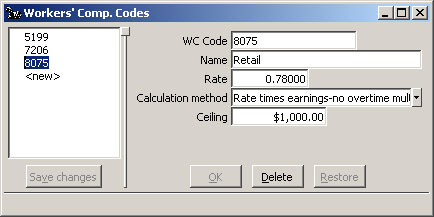

Configure the following WC Codes if you want to see the various options reflected on the Workers’ Compensation Report for Sample Data:

-

WCCode

Description

Rate

Calculation method

Ceiling

8075

Retail

.78

Rate times earnings - no overtime multiplier

$1,000

OK

5199

Maintenance

2.79

Rate times hours

NA

OK

7206

Installation

1.45

Rate times earnings

None

OK

Your completed Payroll Workers’ Comp. Codes configuration window should be similar to this sample.

Click OK and Save changes.

Payroll: Configure Workers’ Comp. Codes window, completed

Back To Top | Back To Main Tutorials Page