21st Century Accounting Tutorials - Bank Accounts

Depositing cash, checks, & credit cards from a register

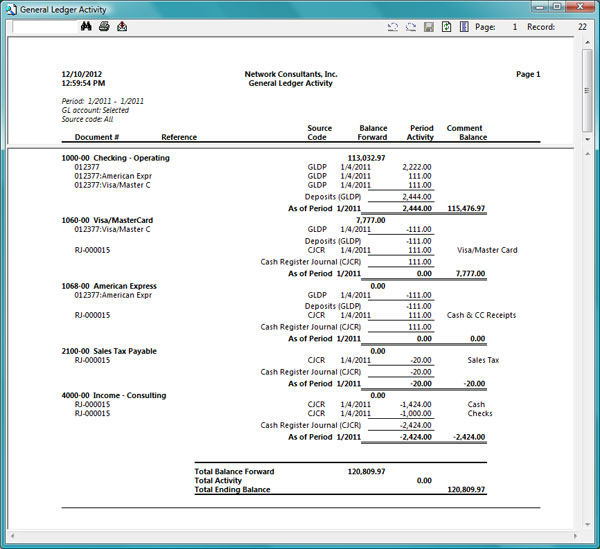

You can set up a special Cash Receipts Journal to use when you deposit a mix of cash and credit card receipts. You enter the receipts as a single entry in the Deposits window. The system records the cash and credit card portions as separate deposits. This shows the credit card receipts as separate deposits, but ties them back to the cash register total for the day (or for some period).Follow these steps:

- Run General Ledger/Configure/Chart of Accounts and add cash equivalent accounts for each credit card you want to track separately.

- Run Bank Accounts/Configure/Credit Card Accounts and set up at least one credit card account by assigning the general ledger account(s) which were set up in Step 1. The Source Code is Credit Card Receipts Journal.

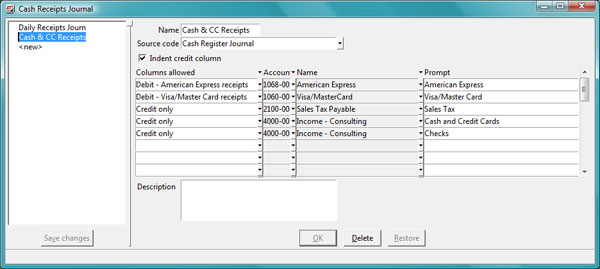

- Run Bank Accounts/Configure/Cash Receipts Journal and start a new journal.

- Name the journal to represent how it is used in your business e.g. "Cash and Credit Card Receipts"; "Daily Receipts"; "Cash Register #___".

- Select CJCR (Cash Register Journal) for the source code.

- Check the box to indent the credit column (optional but recommended).

- At Columns allowed, select "Debit - {credit card name} receipts." (The system appends "receipts" to the name you gave the credit card account when you configured it.) The system automatically inserts the associated G/L account. You can edit the Prompt. The prompt shows in Bank Deposits.

- Repeat Step d for each credit card for which you want to deposit receipts separately.

- Set up any additional accounts for distribution, such as the income and sales taxes account(s) as Credit only entries.

- Click OK and save the new CRJ.

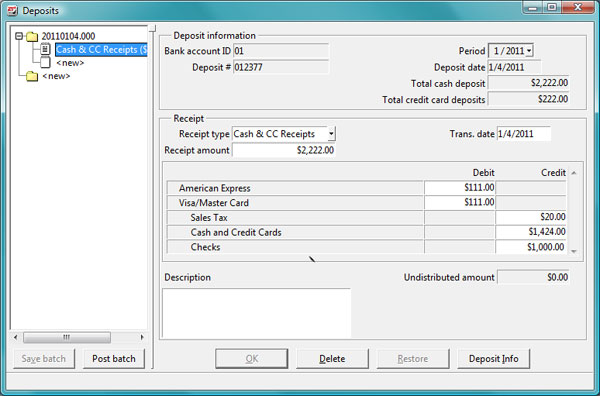

- Run Bank Accounts/Deposits

- At Receipt type, select "Cash and Credit Card Receipts"

- At Receipt amount, enter the total amount of cash to be deposited in the bank (NOT INCLUDING the credit card receipts).

- At each credit card prompt, enter the total receipts for the credit card.

- Finally, credit the total receipt amount (INCLUDING the credit card receipts) to the appropriate income account(s) and, if applicable, sales tax account(s). The Undistributed amount should be $0.00.

- Enter an optional Description, click OK, and save the batch.

- Enter an optional Description and save the batch.

Back To Top | Back To Main Tutorials Page