21st Century Accounting Tutorials - Payroll

Print 941 Information

Run Payroll/Print/941 Information to review information maintained by the system, to enter 941 data that the system does not maintain, such as adjustments, and to print the 941 Information report. You can use the report to fill out the 941 Form, Employer’s Quarterly Federal Tax Return, by hand.

If you have purchased and installed the Tax Form Kit, you can use this command to create a completed Form 941, the Employer’s Quarterly Federal Tax Return. The 941 Form created by the Tax Form Kit is ready to file with the IRS.

The 941 Information program is provided on 21st Century Accounting Payroll Tax Updates, so the window and the report meet current federal requirements. Press the F1 key for Help at the prompts in the window. Refer to the IRS instructions for filling out and filing this form.

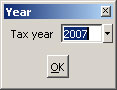

You select the Payroll tax year and quarter when you enter 941 information and print the report.

Payroll: Print 941 Information for tax year

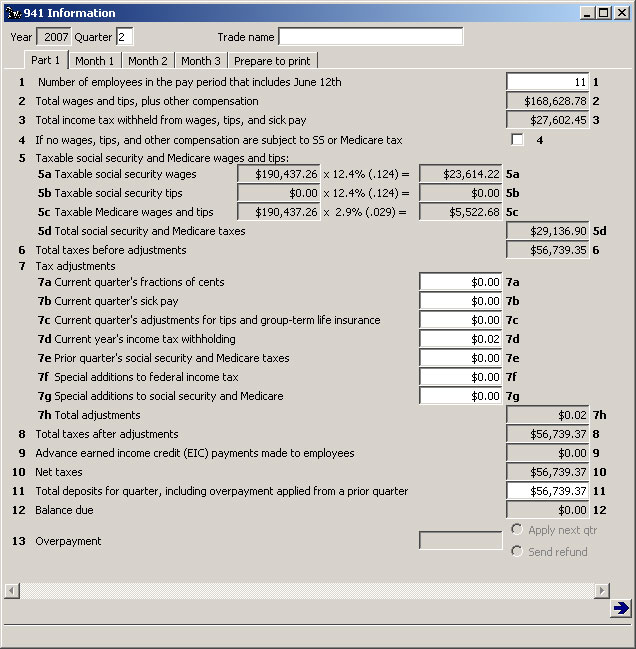

Payroll: Print 941 Information Part 1

Select the sample data company, NETCON.

Run Payroll/Print/941 Information.

In the Tax year window, enter 2007 and click OK.

Quarter. Enter 2 and press Tab.

Line 7a. Tab down to line 7a and type .08 to adjust for the rounding difference between the 941 calculations and the amount actually withheld during Payroll runs.

Tab through each of the 941 panels and review the numbers. Make any other necessary adjustments. Fill in the data that the system doesn’t maintain.

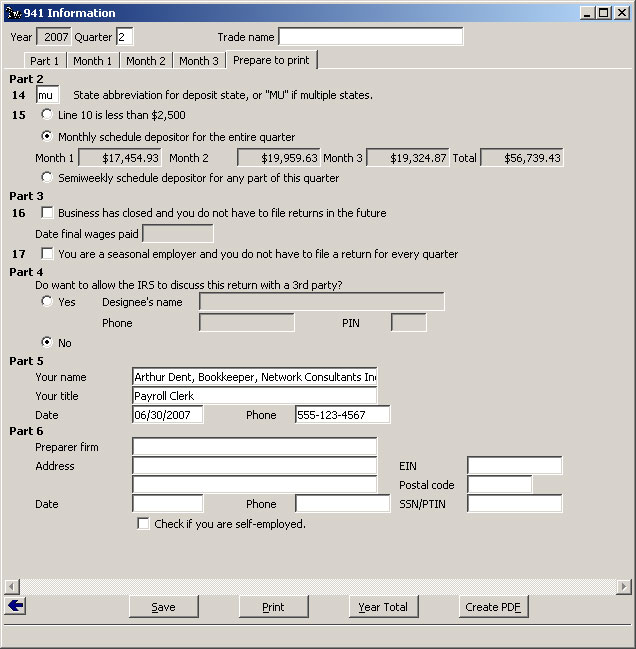

Payroll: Print 941 Information Prepare to print

-

Create PDF. If you installed the Tax Form Kit, the Create PDF button appears at the bottom of the last tab. Click the button when you are ready to create a 941 Form ready to be submitted to the IRS.

If you check "Semiweekly depositor," the Tax Form Kit places the PDF Schedule B Form file in the company folder with the filename 941sb_YEARQX.pdf where YEAR = the year and X = the quarter.

-

Save. Click the Save button to save your work so far.

-

Print. If you don’t have the Tax Form Kit, click the Print button to print the 941 Information report. Use the report to fill in a 941 Form by hand.

-

Year Total. 941only. Click the Year Total button to print a report showing year-to-date totals for 941 data. The report is for your information.

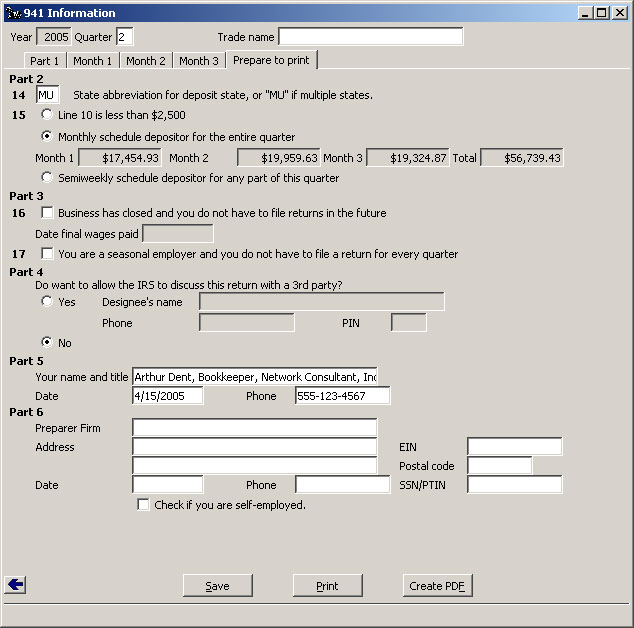

You cannot modify any of the information in the 941 Information window from quarters that have been closed, although you can review and print the 941 for any current or past quarter at any time.

Back To Top | Back To Main Tutorials Page