21st Century Accounting Payroll Tax Updates Download

Payroll Tax Update June 1, 2025

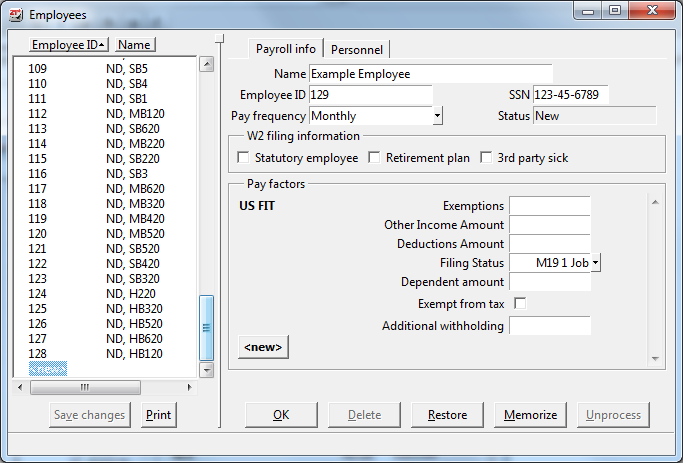

2020 and later W-4

Configuration

STOP!! Please read about the important changes in this Tax Update below BEFORE you install. You can scroll down or click this link to get there.

Please provide your name, email address, and 21st Century Accounting or Payroll for Adagio Product Serial Number to download the latest Payroll Tax Update. You can find your Product Serial number on your C21 main menu under Help/About. This update is available only for registered users of C21 who have a current subscription for Payroll Tax Updates. If you have questions about this Tax Update, please contact us before proceeding.

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Fill out the form and click send to proceed to the download page. All fields are required.

If you are unable to download the Payroll Tax Update, you may need to renew your subscription. Please contact us to renew.

If you receive error message

V03342003, you may have entered your serial number incorrectly. Please re-enter the serial number and try again.

To see a list of past Payroll Tax Update Changes, click here.

21st Century Accounting Payroll Tax Update Changes (Cumulative)

June 1, 2025 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

Federal Forms, Social Security, and Federal Withholding Changes

None

State and Local Income Tax

Idaho (ID SIT)

Utah (UT SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2024 |

2025 |

| NM SUTA | 31,700 |

33,200 |

April 1, 2025 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

Federal Forms, Social Security, and Federal Withholding Changes

2025 Form 941

State and Local Income Tax

Maryland (MD County Taxes)

March 1, 2025 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

State and Local Income Tax

Georgia (GA SIT) - Personal allowances other than those for Dependents are no longer allowed. Please configure your employees to reflect this change.

North Carolina (NC SIT)

February 1, 2025 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

State and Local Income Tax

Hawaii (HI SIT)

Maryland W-2 Efiling adjustment

North Dakota (ND SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2024 |

2025 |

HI SUTA |

59,100 |

62,000 |

ID SUTA |

53,500 |

55,300 |

KY SUTA |

11,400 |

11,700 |

MI SUTA |

9.500 |

9,000 |

MN SUTA |

42,000 |

43,000 |

MT SUTA |

43,000 |

45,000 |

NC SUTA |

31,400 |

32,600 |

ND SUTA |

43,800 |

45,100 |

RI SUTA |

29,200 |

29,800 |

January 1, 2025 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

IMPORTANT NOTE: There are changes in this Tax Update that require reconfiguration for Colorado, Iowa, and Louisiana employees. Please do not install this Tax Update unless you have time to make these changes. All users should backup their companies before installing this Tax Update.

If you subscribe to receive updates on disk, you can expect your disk to arrive within 1-2 weeks. If you do not receive your disk, please let us know.

Federal Forms, Social Security, and Federal Withholding Changes

Support for 2024 Form 944

Support for 2024 Form 940

Support for 2024 Form 940 Schedule A

Federal Social Security Wage Base $176,100

Federal Withholding (FIT)

PLEASE NOTE: You may experience compatibility issues when exporting Forms 944, 940 and 940 Schedule A to PDF. Please check that all the data in the populated PDF matches the data in the form GUI. If any data is missing or incorrect, the boxes can be filled in manually in the PDF form based on the information in the GUI.

State and Local Income Tax

California (CA SIT)

Colorado (CO SIT) - Internal change to configuration that may require employee reconfiguration in Payroll/Configure/Employees

Iowa (IA SIT)*

Kentucky (KY SIT)

Louisiana (LA SIT)*

Michigan (MI SIT)

Missouri (MO SIT)

Montana (MT SIT)

Nebraska (NE SIT)

New Mexico (NM SIT)

Rhode Island (RI SIT)

South Carolina (SC SIT)

*Iowa and Louisiana have both implemented a flat Income Tax rate for 2025. You will need to reconfigure your employees with the following Filing Statuses to accommodate these changes.

Iowa:

Single or Other

Married Filing Joint – 1 Income

Head of Household

Allowances can still be used.

Louisiana:

No Deduction (No deductions claimed)

Single or MFS (Married Filing Separate)

MFJ (Married Filing Joint) or Head of Household

Exemptions and Tax Credits are no longer used.

Reconfigure your employees in Payroll/Configure/Employees. OK the IA and/or LA SIT tax in Payroll/Configure/Taxes to implement the tax change.

SUTA Wage Base (Maximum taxable earnings)

State |

2024 |

2025 |

AK SUTA |

49,700 |

51,700 |

CO SUTA |

23,800 |

27,200 |

CT SUTA |

25,000 |

26,100 |

DE SUTA |

10,500 |

12,500 |

IL SUTA |

13,590 |

13,916 |

IA SUTA |

38,200 |

39,500 |

MO SUTA |

10,000 |

9,500 |

NJ SUTA |

42,300 |

43,300 |

NV SUTA |

40,600 |

41,800 |

NY SUTA |

12,500 |

12,800 |

OK SUTA |

27,000 |

28,200 |

OR SUTA |

52,800 |

54,300 |

UT SUA |

47,000 |

48,900 |

VT SUTA |

14,300 |

14,800 |

WA SUTA |

68,500 |

72,800 |

WV SUTA |

9,521 |

9,500 |

WY SUTA |

30,900 |

32,400 |

December 1, 2024 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal Forms

Support for Federal Electronic Filing for 2024 Form W-2

Support for SSA Plain Paper for 2024 Form W-2 and W-3

Support for Office Depot Pre-printed 2024 Form W-2/W-3

Support for Dynamic Systems Pre-printed 2024 Form W-2/W-3

Support for Blue Summit (Amazon) Pre-printed 2024 Form W-2/W-3

August 1, 2024 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal Forms

None

State and Local Income Tax

Kansas (KS SIT)

SUTA Wage Base (Maximum taxable earnings)

None

July 1, 2024 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal Forms

None

State and Local Income Tax

Arkansas (AR SIT)

Idaho (ID SIT)

Ohio (OH SIT)

Utah (UT SIT)

SUTA Wage Base (Maximum taxable earnings)

None

April 1, 2024 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal Forms

Support for 2024 Form 941

Support for 2024 Form 941 Schedule B

Please review the forms once they populate to confirm that all information from the 941 module has transferred. These forms are fill-in forms so any information that may be missing can be manually entered.

State and Local Income Tax

California DE9 2024

SUTA Wage Base (Maximum taxable earnings)

State |

2024 |

2023 |

| NM SUTA | 31,700 | 30,100 |

February 1, 2024 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal Social Security and Withholding changes

None

Federal Forms

None

State and Local Income Tax

Iowa (IA SIT)

Missouri (MO SIT)

Vermont (VT SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2024 |

2023 |

| HI SUTA | 59,100 | 56,700 |

| NC SUTA | 31,400 | 20,600 |

| ND SUTA | 43,800 | 40,800 |

| NM SUTA | 31,500 | 30,100 |

January 1, 2024 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal Social Security and Withholding changes

2024 Social Security Wage Base is $168,600

2024 Federal Income Tax (US FIT)

Federal Forms

2023 Form 944

2023 Form 940

2023 Form 940 Schedule A

PLEASE NOTE: You may experience compatibility issues when exporting Form 940 and 940 Schedule A to PDF. Please check that all the data in the PDF matches the data in the module. If any data is missing or incorrect, the boxes can be filled in manually in the PDF form based on the information in the module.

Additional Notes for W-2 Electronic Filing:

- We highly recommend you test your W-2 file in the AccuWage Online tab before submitting your file to the SSA to check for any errors.

- To submit your file to the SSA, the file will need to be renamed before submitting. Your file will be called W2REPORT_2023.FED. Right-click and replace FED with txt. It should not be necessary to zip the file.

- There has been some confusion about the User ID and whether it is required. Even though the BSO has changed the login procedure, the User ID is still required according to the W-2 electronic filing specifications for 2023.

State and Local Income Tax

Arkansas (AR SIT)

California (CA SIT)

California - SDI withholding rate for 2024 is 0.11 percent. There is no longer a wage limit.

Connecticut (CT SIT)

Georgia (GA SIT)

Kentucky (KY SIT)

Maine (ME SIT)

Montana (MT SIT)*

Nebraska (NE SIT)

New Mexico (NM SIT)

North Carolina (NC SIT)

Support for Ohio Electronic Filing W-2s

Rhode Island (RI SIT)

South Carolina (SC SIT)

*Montana has added Head of Household as a filing status. The MT SIT will need to be configured by clicking OK on your employees in Payroll/Configure/Employees. You do not need to change the filing status unless your employee turns in a new MW-4 with a changed status. OK the MT SIT tax in Payroll/Configure/Taxes to configure it for theses changes.

- Single - Single, Married Filing Separately, and Married Filing Joint both Spouses working, 1a on Form MW-4

- Married - Married Filing Jointly or Qualified Widower, 1b on Form MW-4

- Head of Household - Head of Household, 1c on Form MW-4

SUTA Wage Base (Maximum taxable earnings)

State |

2024 |

2023 |

| AK SUTA | 49,700 | 46,80 |

| CO SUTA | 23,800 | 20,400 |

| CT SUTA | 25,000 | 15,000 |

| ID SUTA | 53,500 | 50,000 |

| IL SUTA | 13,590 | 12,960 |

| IA SUTA | 38,200 | 36,100 |

| KY SUTA | 11,400 | 11,100 |

| MN SUTA | 42,000 | 41,000 |

| MO SUTA | 10,000 | 10,500 |

| MT SUTA | 43,000 | 40,500 |

| NJ SUTA | 42,300 | 41,100 |

| NV SUTA | 40,600 | 40,100 |

| NY SUTA | 12,500 | 12,300 |

| OK SUTA | 27,000 | 25,700 |

| OR SUTA | 52,800 | 50,900 |

| RI SUTA | 29,200 | 24,600 |

| RI SUTA | 30,700 | 26,100 |

| UT SUA | 47,000 | 44,300 |

| VT SUTA | 14,300 | 13,500 |

| WA SUTA | 68,500 | 67,600 |

| WV SUTA | 9,521 | 9,000 |

| WY SUTA | 30,900 | 29,100 |

December 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

W-2 Support for Electronic Filing

W-2 and W-3 Support for Plain Paper Forms 2023

W-2 and W-3 Support for Office Depot Forms 2023

W-2 and W-3 Support for Amazon Blue Summit Forms 2023

W-2 and W-3 Support for Dynamic Systems Forms 2023

State and Local Income Tax

None

August 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

None

State and Local Income Tax

Arkansas (AR SIT)

North Dakota (ND SIT)

July 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

None

State and Local Income Tax

Idaho (ID SIT)

June 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

None

State and Local Income Tax

Utah (UT SIT)

April 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

2023 Form 941

State and Local Income Tax

West Virginia (WV SIT)

March 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not configured your employees with 2020 W-4 Tax Tables, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

None

State and Local Income Tax

Michigan (MI SIT)

Oregon (OR SIT)

Vermont (VT SIT)

February 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

None

State and Local Income Tax

Colorado (CO SIT)

Maryland (MD SIT)

Missouri (MO SIT)

North Carolina (NC SIT)

North Dakota (ND SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2022 |

2023 |

| AK SUTA | 39,900 | 46,80 |

| AR SUTA | 7,000 | 10,000 |

| DE SUTA | 14,500 | 18,500 |

| HI SUTA | 51,600 | 55,800 |

| ID SUTA | 46,500 | 50,000 |

| IL SUTA | 12,740 | 13,271 |

| MN SUTA | 38,000 | 41,000 |

| NC SUTA | 28,000 | 29,600 |

| ND SUTA | 38,400 | 40,800 |

| OR SUTA | 47,700 | 50,900 |

| RI SUTA | 24,000 | 24,600 |

January 1, 2023 Payroll Tax Update

This Tax Update includes the FIT changes for 2020 W-4s

If you have not previously reconfigured your employees and are not ready to do so for 2020 W-4s, please click here to install the Payroll Tax Update which includes everything below with FIT for 2019 or earlier W-4s ONLY. Please backup your company data before you install this Tax Table or make a copy of your C21/data folder to a safe location. If you install this Tax Table and receive a C21 message indicating that you need to reconfigure you employees for US FIT, you have installed the incorrect Tax Table. Close C21 and install the correct Tax Table and then restore your company backup.

Federal

2023 Social Security Wage Base is $160,200.

2022 Form 944

2022 Form 940

2022 Form 940 Schedule A

PLEASE NOTE: You may experience compatibility issues when exporting Form 940 and 940 Schedule A to PDF. Please check that all the data in the PDF matches the data in the dialog box. If any data is missing or incorrect, the boxes can be filled in manually based on the information in the dialog box.

State and Local Income Tax

Some states are implementing mandatory FMLA taxes in 2023. Two such states are Oregon and Colorado. These taxes should be entered as User Taxes. Please see Hot Topics for instructions on how to implement this type of User Tax.

California - SDI withholding rate for 2023 is 0.9 percent. The taxable wage limit is $153,164.

California (CA SIT)

Iowa (IA SIT)

Kentucky (KY SIT)

Maine (ME SIT)

Minnesota (MN SIT)

Montana (MT SIT)

Nebraska (NE SIT)

New Mexico (NM SIT)

New York State (NY State SIT)

New York Yonkers (Yonkers CIT)

Pennsylvania - The 2023 tax rate for employees increases to 0.07% with the wage base holding at $10,000.

Rhode Island (RI SIT)

South Carolina (SC SIT)

SUTA Wage Base (Maximum taxable earnings)

State |

2022 |

2023 |

| AK SUTA | 39,900 | 46,80 |

| AR SUTA | 7,000 | 10,000 |

| AZ SUTA | 7,000 | 8,000 |

| CO SUTA | 17,000 | 20,400 |

| HI SUTA | 51,600 | 55,800 |

| IA SUTA | 34,800 | 36,100 |

| ID SUTA | 46,500 | 50,000 |

| IL SUTA | 12,740 | 12,960 |

| KY SUTA | 10,800 | 11,100 |

| MN SUTA | 38,000 | 41,000 |

| MT SUTA | 38,100 | 40,500 |

| NC SUTA | 28,000 | 30,000 |

| NJ SUTA | 39,800 | 41,100 |

| NM SUTA | 28,700 | 30,100 |

| NV SUTA | 36,600 | 40,100 |

| NY SUTA | 12,000 | 12,300 |

| OK SUTA | 24,800 | 25,700 |

| OR SUTA | 47,700 | 50,900 |

| RI SUTA | 24,000 | 24,600 |

| RI SUTA | 25,100 | 26,100 |

| UT SUA | 41,600 | 44,300 |

| WA SUTA | 62,500 | 67,600 |

| WY SUTA | 27,700 | 29,100 |

COVID-19 Related Sick Pay

COVID-19 Families First Coronavirus Response Act (FFCRA) US Social Security Employer exemption

This Tax Update contains changes related to FFCRA Sick Pay. If you have employees entitled to this type of pay, you will need to create the following new Income factors for wages required to be paid under the Emergency Paid Sick Leave Act (ESPLA) as enacted under the FFCRA. This Act requires employers with less than 500 employees to provide paid sick leave to employees unable to work or telework after March 31, 2020, and before January 1, 2021 due to reasons outlined below.

Create one or both of the following Income Factors to implement these changes:

In these circumstances, you are entitled to a maximum of $511 per day, or $5,110 total over the entire paid sick leave period.

- Are subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

- Have been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

- Experiencing symptoms of COVID-19 and are seeking medical diagnosis. This falls under the Emergency Paid Sick Leave Act.

In these circumstances, you are entitled to compensation at 2/3 of the greater of the amounts above at a maximum of $200 per day, or $2,000 over the entire two week period.

- Caring for an individual who is subject to a Federal, State, or local quarantine or isolation order related to COVID-19 or an individual who has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

- Caring for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons;

- Experiencing any other substantially-similar condition that may arise, as specified by the Secretary of Health and Human Services

This Income must be subject to US SS and any other taxes related to this sick pay. Once you create this Income factor, apply it to eligible employees.

If you previously created an Income for this type of sick pay under a different name, you should change the Income name to COVIDSICK and/or COVIDCARE. In order for this change to be applied to eligible sick pay, it must be called COVIDSICK or COVIDCARE in all caps.

Qualified family leave wages you paid to your employees under the Emergency Family and Medical Leave Act under the FFCRA. This requires employers with less than 500 employees to provide public health emergency leave under the Family and Medical Leave Act of 1993 to an employee who has been employed for at least 30 calendar days. The requirement to provide leave generally applies when an employee is unable to wok or telework due to the need to care for a child under the age of 18 because the school or place of care has been closed, or the childcare provider is unavailable, due to a public health emergency. The first 10 days for which an employee takes leave may be unpaid. During this period, employees may use other forms of paid leave, such as qualified sick leave, accrued sick leave, annual leave, or other paid time off. After an employee takes leave for 10 days, the employer must provide the employee paid leave for up to 10 weeks. The qualified family leave wages can't exceed $200 per day or $10,000 in the aggregate per employee for the year.

Once you create one or both of these Income factors, apply them to eligible employees. This Income must be subjct to US SS and any other taxes related to this sick pay.

If you previously created an Income for these types of sick pay or family leave under a different name, you should change the Income name to COVIDSICK, COVIDCARE, or COVIDFAMILY. In order for this change to be applied to eligible sick pay, it must be called COVIDSICK, COVIDCARE, or COVIDFAMILY in all caps.

Please click here for more detailed instructions on applying these changes.

Instructions for configuring your employees for 2020 W-4s or previous W-4s

Questions?

If you have questions about this information or require our assistance, please contact us here.

Please do the following before installing this update:

- Make a backup of all of your companies.

- Once you install a Tax Update configured for 2020, if you have not previously reconfigured your employees for 2020 W-4s, you will need to go to Payroll/Configure/Employees and reconfigure whichever employees you need to Calculate Payroll for in the future. In other words, you cannot run a payroll for any employee that has not been reconfigured. You do not need to reconfigure employees that you do not need to run payroll for.

- For tips on more efficient payroll configuration, see our Hot Topic: C21 Tips for Efficient Payroll

Configuration information for this Payroll Tax Update

Due to changes to Federal Income Taxes for 2020, you will need to reconfigure your employees before calculating your next payroll, even if you are not using 2020 W-4s. Please keep this in mind before installing this Tax Update as you will need to reconfigure your employees in order for these Tax Tables to be implemented.

After installing this Tax Update, if you do not see the new fields available in Configure/ Employees, go to Payroll/Calculate Payroll, and start a 2020 payroll. Close out of Calculate Payroll and you should see the fields in Configure/Employees.

If you have multiple employees you can reconfigure a little at a time by saving your changes as you go. However, you will not be able to Calculate Payroll for employees that have not bee reconfigured. You can also OK all of your employees and then go back and reconfigure them when you are able. Please note that when you OK your employees, the filing status will default but the status may not be correct. Please double check the status before you run payroll for those employees.

Below you will see references to 2019 Form W-4. This applies to Form W-4 from previous years as well. If an item below only references 2020 Form W-4, you can leave that box blank if you are using a previous year's form.

In Payroll/Configure/Employees, you will see the following Pay Factors for US FIT :

Exemptions – If you are using 2019 Form W-4, leave the number of exemptions as they are. If you are using 2020 Form W-4, use the chart below to enter the correct number:

Filing Status |

Step 2 |

Number to enter |

Married Filing Jointly |

Step 2 NOT checked |

3 |

Single, Head of Household, Married Filing Separately |

Step 2 NOT checked |

2 |

All Filing Statuses |

Step 2 Checked |

0 |

Other Income Amount – Enter the amount in Step 4(a) of your 2020 W-4 Form.

Deductions Amount - Enter the amount in Step 4(b) of your 2020 W-4 Form.

Filing Status - Use the tables below to enter the correct status.

2019 Form W-4:

Filing Status |

Status Code |

Married Filing Jointly |

M19 1 Job |

Single, Married Filing Separately, or Head of Household |

S19 1 Job |

Nonresident Alien |

NRA |

2020 Form W-4 Step 2 NOT checked:

Filing Status |

Status Code |

Married Filing Jointly |

M19 1 Job |

Single or Married Filing Separately |

S19 1 Job |

Head of Household |

H20 1 Job |

2020 Form W-4 Step 2 Checked:

Filing Status |

Status Code |

Married Filing Jointly |

MFJ20 2 Job |

Single or Married Filing Separately |

S20 2 Job |

Head of Household |

H20 2 Job |

Nonresident Alien |

NRA2020 |

Dependent Amount – Enter the currency amount listed on 2020 Form W-4 in Step 3.

Exempt from Tax – Check this box if the employee is exempt from tax.

Additional Withholding – Enter the currency amount listed on the 2020 Form W-4 in Step 4(c). This is the additional amount to be withheld per pay period.

North Dakota SIT

Please be aware of the following changes to North Dakota statuses and allowances. You will need to reconfigure your employees in Payroll/Configure/Employees before you will be able to Calculate Payroll.

Form |

Factor |

Change |

2019 Form W-4 |

Head of Household |

Select Filing Status 19 Head of Household |

2020 Form W-4 |

Head of Household |

Select Filing Status 20 Head of Household |

2020 Form W-4 |

Allowances |

Enter Zero Allowances |